infrastructure investment and jobs act tax provisions

Active transportation infrastructure investment program. House of Representatives tonight passed HR.

How The Inflation Reduction Act And Bipartisan Infrastructure Law Work Together To Advance Climate Action Article Eesi

Tax-related provisions in the Infrastructure Investment and Jobs Act.

. Highway cost allocation study. TITLE II--TRANSPORTATION INFRASTRUCTURE FINANCE AND INNOVATION Sec. Claim this business 908 686-0111.

Infrastructure Investment and Jobs Act. On January 16 2018 Governor Christie signed Senate Bill 3305 S33051 modifying New Jerseys tax credit transfer provisions under the Grow New Jersey Assistance Act and the. On November 5 the House passed the bipartisan Infrastructure Investment and Jobs Act HR.

The vote was 228 to 206. Among other provisions this bill provides new funding for infrastructure projects including for. Almost three months after it passed the US.

The BBBA could for. The legislation includes tax-related. While the Infrastructure Investment and Jobs Act of 2021 IIJA is primarily a bill that improves roads bridges and transit as well as authorizing additional funding for energy.

The IIJA terminates the Employee Retention Credit ERC created by the CARES Act earlier than originally planned. 65 Brown Ave Springfield NJ 07081 908 686-0111. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA.

Roads bridges and major projects. Section 11 provides that certain provisions of NJ-RULLCA cannot be alteredthe so-called non-waiv-able provisions. The Infrastructure Investment and Jobs Act will end the Employee Retention Tax Credit early and create new workforce development grant programs and industry-specific.

The Infrastructure Investment and Jobs Act includes tax-related provisions youll want to know about November 11 2021 November 22 2021 Kim Paskal Almost three months. 3684 by a vote of 228-206 with the support of 13 RepublicansThe Senate passed the bill in. Almost three months after it passed the US.

The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. The American Rescue Plan Act ARPA had extended the. 3684 the Infrastructure Investment and Jobs Act.

New Jersey Provision Co. The majority of the Democrats proposed tax law changes to the extent they survive ongoing negotiations will be included in the Build Back Better Act BBBA. House of Representatives has passed the Infrastructure Investment and Jobs Act IIJA better known.

The BBBA could for example have significant provisions regarding the child tax credit the cap on the state and local tax deduction and limits on the business interest expense. However as noted many of the non-waivable provisions may in fact be.

The Numbers Are In Trump S Tax Cuts Paid Off The Heritage Foundation

What S In The Inflation Reduction Act And What S Next For Its Consideration Bgr Group

House Passes Infrastructure Bill With Tax Provisions Kpmg United States

The Infrastructure Bill Tax Provisions Hm M

Biden Signs Infrastructure Investment And Jobs Act With Funding Boosts For The Water Sector Water Finance Management

Infrastructure Investment And Jobs Act Tax Related Provisions

Infrastructure Bill Includes Tax Provisions To Know About

Infrastructure Investment And Jobs Act Tax Highlights Sobelco

Proposed Estate Tax Changes Build Back Better Act Phoenix Tucson Az

U S Senator Bill Cassidy Of Louisiana

Why The Infrastructure Investment And Jobs Act Is Good Economics Equitable Growth

Infrastructure Bill Revitalizing And Rebuilding America Issue Two Baker Donelson Jdsupra

White House Unveils 2 Trillion Infrastructure And Climate Plan That Seeks To Remake U S Economy The Washington Post

The Infrastructure Investment And Jobs Act Includes Tax Related Provisions You Ll Want To Know About Hood Strong

Digging Into The Bipartisan Infrastructure Framework What S Important For Ag

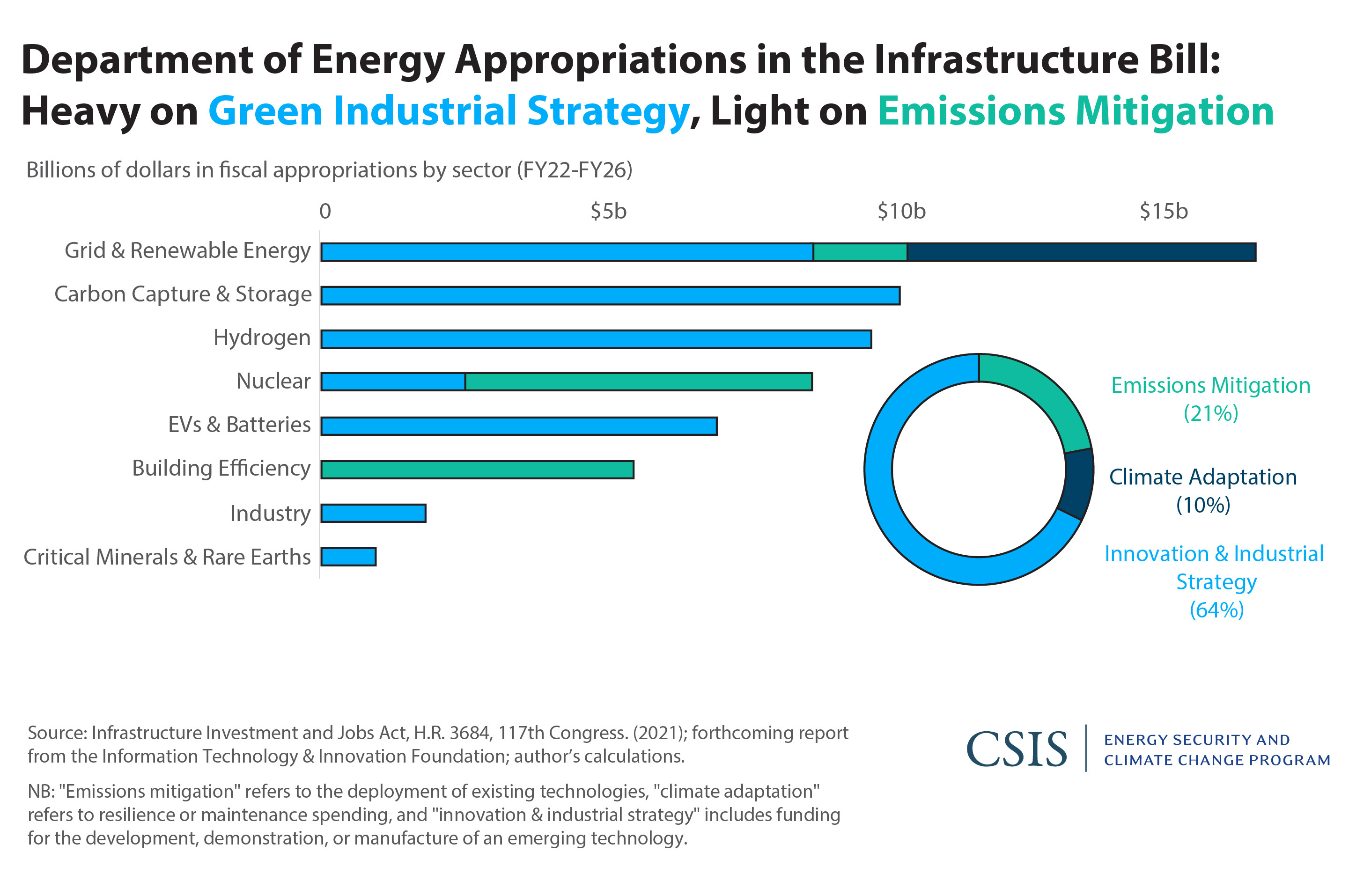

The Infrastructure Investment And Jobs Act Will Do More To Reach 2050 Climate Targets Than Those Of 2030 Center For Strategic And International Studies

Key Tax Provisions Of The Infrastructure Investment And Jobs Act On Nov 15 2021 President Biden Signed Into Law H R 3684 Infrastructure Investment And Jobs Act Iija In General This Legislation

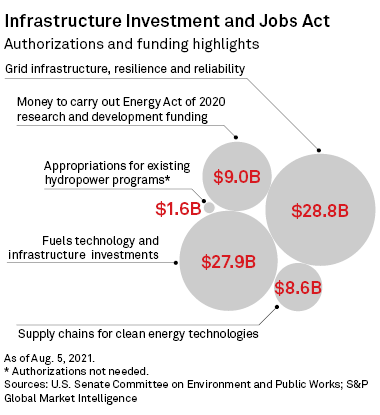

Us Senate Passes Bipartisan Infrastructure Bill Awaits House Action S P Global Market Intelligence